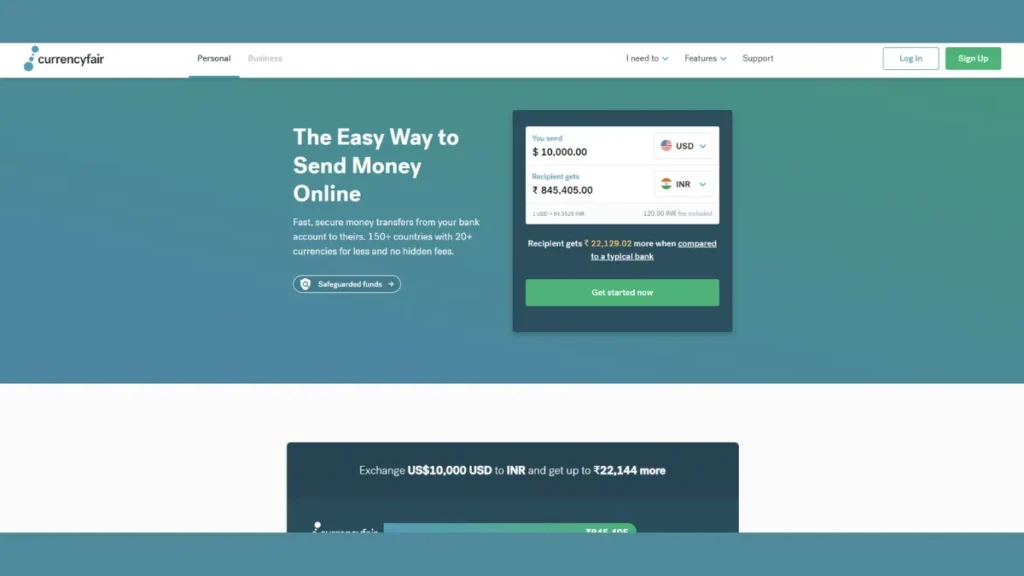

CurrencyFair is a peer-to-peer (P2P) money transfer platform that allows individuals and businesses to exchange currencies at near-market rates. Launched in 2009 and headquartered in Ireland, CurrencyFair enables fast and cost-effective international transfers with transparent fees, making it an excellent alternative to traditional banks and other remittance providers.

What sets CurrencyFair apart is its unique marketplace model, where users can set their own exchange rates and wait for a match — or instantly send money using the best available rate.

Quick Review Summary:

Founded: 2009

Headquarters: Dublin, Ireland

Available In: 150+ countries

Best For: Transparent, low-fee currency transfers

Rating: ⭐ 4.5/5

In-Depth Review of CurrencyFair

Peer-to-Peer Exchange Marketplace

Get better-than-bank rates by matching with other users.Low, Flat Transfer Fee

Typically around €3 (or currency equivalent) per transaction.Multi-Currency Account

Hold and convert multiple currencies under one account.Transparent Pricing

No hidden charges — upfront fee + clearly stated margin (usually ~0.45%).Global Reach

Supports 20+ currencies and 150+ countries.Business Account Option

Tailored tools for startups, freelancers, and global businesses.

Who Uses CurrencyFair?

Freelancers, expats, and remote workers receiving international payments

Businesses paying overseas employees or suppliers

Individuals sending funds for property, tuition, or relocation

Users looking for better exchange rates without high bank fees

Near-market exchange rates

Fixed, low transfer fees

Fast transfer speeds (1–2 days)

Regulated in multiple jurisdictions

Marketplace feature can save money

Limited cash pickup or delivery options

Fewer supported currencies compared to giants like Wise

Matching in P2P marketplace may take time (optional)

User Testimonials:

Frequently Asked Questions (FAQs)

1. Is CurrencyFair regulated?

Yes, it’s licensed and regulated in the EU, Australia, Hong Kong, and other regions.

2. What currencies does it support?

Over 20 currencies including USD, EUR, GBP, AUD, CAD, INR, and more.

3. Can I use CurrencyFair for business payments?

Absolutely. They offer dedicated business accounts and bulk payment options.

4. How does the P2P exchange work?

Users set a desired rate and wait to match with another user — or use the best available rate instantly.

5. How long does a transfer take?

Typically 1–2 working days after the funds are received.

Disclaimer: This website provides free online resources designed to deliver helpful content and comparison features. While we aim for objectivity, we may receive advertising compensation from certain service providers featured on our platform, which could influence the rating and ranking of these providers. It’s important to understand that our listings do not constitute endorsements. Our ranking and rating system is based on a combination of user experience, views, ratings, and comments. The information and site are provided “as is,” and your use of the site is at your own risk. We strive to keep information, including pricing and reviews, accurate and up-to-date, but may not cover all service providers worldwide, focusing instead on recommending top brands based on our research and expertise. Additionally, as a comparison site, we offer coupons and links to brands’ websites. Please note, we do not endorse or sell any products containing illegal substances or those that violate Google’s advertising policies.