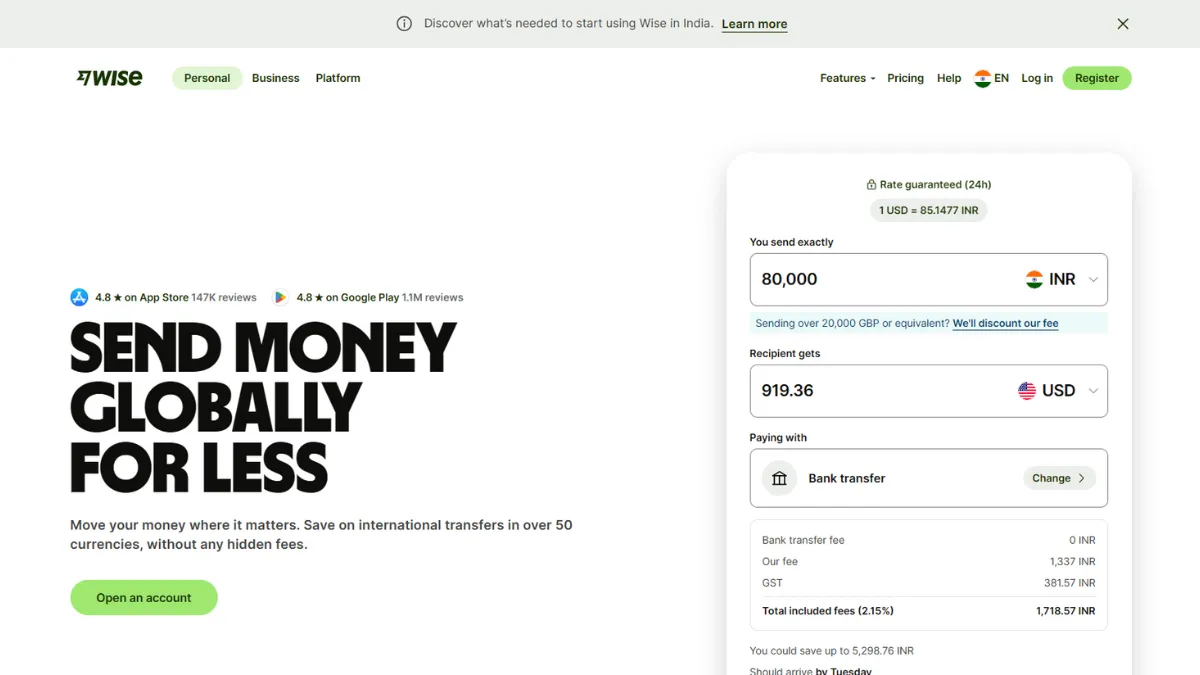

Wise (formerly TransferWise) is a global financial technology company that specializes in international money transfers, multi-currency accounts, and borderless banking solutions. Founded in 2011 in London, Wise is trusted by millions to send, spend, and receive money across borders — faster and cheaper than traditional banks.

With Wise, users can hold balances in over 50 currencies, receive money with local bank details, convert money at real exchange rates (mid-market rate), and enjoy full transparency with no hidden fees. Whether you’re a freelancer, business owner, remote worker, or traveler, Wise provides a smarter way to manage global money.

Quick Review Summary:

Founded: 2011

Headquarters: London, UK

Currencies Supported: 50+

Best For: International money transfers & multi-currency account management

Rating: ⭐ 4.8/5

In-Depth Review of Wise

Real Exchange Rates

Wise uses the mid-market rate without markup — the same rate you see on Google or XE.Low, Transparent Fees

Fees are clearly shown before you confirm the transfer — no hidden costs.Multi-Currency Account

Hold, convert, and manage over 50 currencies in one account.Local Bank Details

Receive payments like a local in the US, UK, EU, Australia, and more — ideal for freelancers and businesses.Wise Debit Card

Spend abroad with low conversion fees and no foreign transaction charges.Business Solutions

Wise Business offers batch payments, Xero integration, and international payroll management.Fast Transfers

50% of transfers arrive within an hour — faster than most traditional banks.

Who Uses Wise?

Freelancers receiving international payments

Expats managing multi-currency balances

Travelers and digital nomads spending abroad

Remote workers and employees

Small businesses paying overseas vendors

E-commerce sellers collecting payments globally

Transparent, real-time exchange rates

Extremely low transfer fees

Multi-currency wallet with global access

Great for both personal and business use

Fast, reliable service with a global footprint

Supports Apple Pay and Google Pay

No cash pickup service (bank-to-bank only)

Debit card availability is region-specific

Some countries and currencies not supported

Not a full-service bank (limited to transfers and currency)

User Testimonials:

Frequently Asked Questions (FAQs)

1. Is Wise safe to use?

Yes. Wise is regulated by financial authorities in multiple countries and uses bank-level security.

2. How does Wise work?

Wise matches transfers between users in different countries to avoid international fees and uses the real exchange rate.

3. What currencies can I hold in my Wise account?

Wise supports 50+ currencies, including USD, EUR, GBP, INR, AUD, and more.

4. Is Wise cheaper than PayPal?

Yes, Wise usually offers much lower fees and better exchange rates than PayPal for international transfers.

5. Can I get a Wise debit card?

Yes, in supported regions (like the UK, EU, US, Australia), you can order a Wise multi-currency card.

6. Does Wise work for businesses?

Yes, Wise Business allows you to send bulk payments, manage invoices, and receive money like a local.

7. How fast is Wise?

Most transfers are completed within 24 hours — many within minutes, depending on the currency pair and bank hours.

Disclaimer: This website provides free online resources designed to deliver helpful content and comparison features. While we aim for objectivity, we may receive advertising compensation from certain service providers featured on our platform, which could influence the rating and ranking of these providers. It’s important to understand that our listings do not constitute endorsements. Our ranking and rating system is based on a combination of user experience, views, ratings, and comments. The information and site are provided “as is,” and your use of the site is at your own risk. We strive to keep information, including pricing and reviews, accurate and up-to-date, but may not cover all service providers worldwide, focusing instead on recommending top brands based on our research and expertise. Additionally, as a comparison site, we offer coupons and links to brands’ websites. Please note, we do not endorse or sell any products containing illegal substances or those that violate Google’s advertising policies.

Related posts

Categories

- Airline (10)

- CBD Brands (38)

- Cybersecurity software (12)

- E-commerce and Online Business (6)

- Game Key Marketplaces (2)

- Health & Wellness (18)

- Hosting Provider (1)

- Money Transfer (7)

- Music Streaming (1)

- Online Learning (10)

- Transportation and Rentals (15)

- Travel and Tourism (3)

- Travel Booking Platforms (9)

- Website Builder (10)

Stay connected